Report covers the 2018 calendar year, and January 1-May 9 2019.

The move from ‘Crypto Winter’ into ‘Crypto Spring’

The cryptocurrency market of 2018 might be best described as having experienced a year-long ‘crypto winter’. The peak market capitalisation of all cryptocurrency listed on exchanges monitored by CoinMarketCap clocked in on January 8, 2018, at $833 billion. This is the highest value ever recorded. It went on to decline some 87.75% over the next 12 months to reach a 17-month low of $102 billion by December 16, 2018.

Since then, just over four months have passed and the market has seen significant recovery, with growing speculation that the winter is finally over and the cryptocurrency landscape is beginning to feel the warmth of a ‘crypto-spring’.

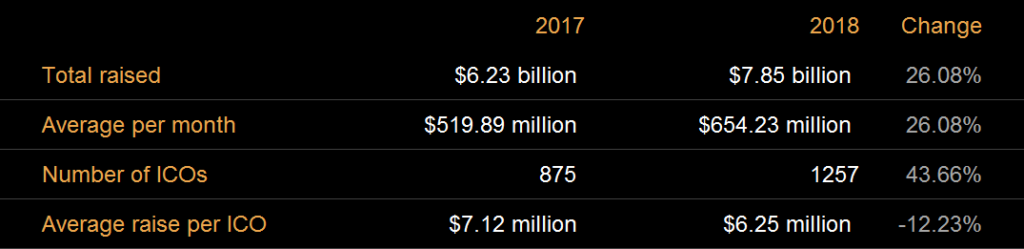

Despite the bear market, raising capital through the creation and issuance of tokens, known as Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs) and the like, grew. Total ICO funding reached $7.85 billion dollars in 2018 – 26.08% more than 2017 ($6.23 billion) according to icodata.io.

Capital Raised in 2018 via Initial Coin Offering (ICO)

Note: Values are notional USD

New cryptocurrencies launched and trading volume is at record levels in 2018 and 2019 to date. 24-hour trading volume hit an all-time daily high of over $88.9 billion on April 3, 2019, according to CoinMarketCap. Even when accounting for the unfortunate impact of probable wash trading in CoinMarketCap volumes, this is a striking increase, which likely still reflects very real growth in the digital asset markets.

The HiveEx Cryptocurrency Landscape Report 2019, reviews what happened throughout 2018 and the start of 2019, which is shaping up to be an exciting year. Despite its ups and downs, one aspect about the blockchain space that remains unchanged is the relentless dedication, innovation and resourceful communities who are dead set on shaping the future of blockchain and indeed the future of the world.

Part 1

2018: The Crypto Winter

2018 market capitalisation & trade volume

Note: Values are notional USD

Market capitalisation

- A dramatic drop in market capitalisation across the entire cryptocurrency ecosystem saw the year closing 78.70% down.

- On January 1, 2018, total market cap was valued at $612.93 billion and fell to $130.54 billion by the year’s end.

- The highest peak in 2018 was on January 8, when total market cap reached $833.44 billion.

- The lowest point was on December 16, 2018, when market cap fell to $102.09 billion.

24-hour trading volume

- 24-hour trading volume also took a dive in 2018, dropping by more than half.

- On January 1, 2018, 24-hour trading volume was recorded at $31.42 billion and by the end of 2018, it sat at $14.92 billion – a decrease of 52.52%

- At the height of 2018 on January 8, 24-hour trade volume reached $43.57 billion, while the low point was $9.66 billion on December 16.

- These are the same recorded high and low days as market capitalisation.

Bitcoin dominance in 2018

2018 bitcoin market share

- BTC began 2018 with a market share of 38.62% when there were 1,365 cryptocurrencies monitored by CoinMarketCap.

- By the end of 2018, while there were 709 more cryptocurrencies monitored, bitcoin’s (BTC) market share reached 51.69% – an increase of 33.84%.

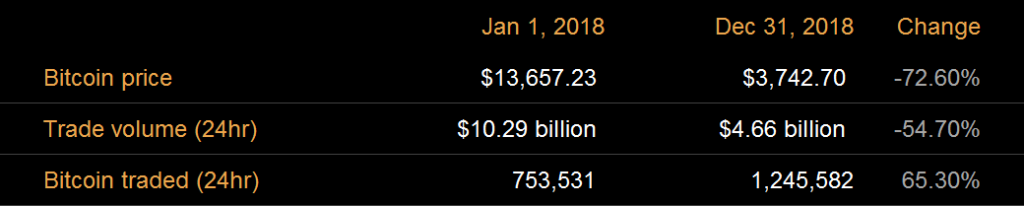

Bitcoin price movement in 2018

2018 – bitcoin price and volume

Note: Values are notional USD

- Bitcoin’s price fell by 72.60% over 2018, from $13,657.23 at the start of the year to $3,742.70 – levels not seen since October 2017.

- Despite the decline in price, the total number of coins traded rose 65.30%.

- Based on 24-hour trading volume and the price per BTC, on January 1, 2018 there were 753,531 BTC traded compared to almost 1.25 million on December 31, 2018.

Managing ICO capital in 2018

- Despite first originating in 2013, Initial Coin Offerings (ICOs) became the spark that ignited the bull market of 2017, raising an estimated $6.23 billion in capital for projects and dwarfing 2016 some 40 times over.

- Following the peak of prices on January 8, 2018, many projects that raised funds were quickly found in a race to the bottom, where they were forced to make a tough decision to either hold their funds in Ethereum, or liquidate into fiat currency to ensure support their ambitious roadmaps.

- This is largely attributed as a major factor in the long and devastating decline in cryptocurrency prices. More and more projects sold their treasuries to avoid being last in the self-fulfilling prophecy that was becoming more apparent as each week ticked along.

ICOs as a mechanism for scams

- Due to the lack of regulatory oversight, historical performance and the ease of being able to receive large amounts of money for newly minted tokens, the space was riddled with malicious actors.

- Dedicated to mislead potential investors, they promised world-changing solutions and offered hard to evaluate opportunities. It’s estimated that as early as February 2018, more than 46% of ICOs from the previous year had either failed, mismanaged investor funds or disappeared entirely without a trace.

Significant developments in 2018

- Cryptocurrency through blockchain innovation produced significant developments across a wide range of projects in 2018.

- Binance and the Binance Coin (BNB), an ethereum-based token, established a robust methodology for delivering value to token holders by ensuring deep utility on the exchange and many peripheral initiatives, rising from the rank of 38 to 13th in market share.

- On the bitcoin blockchain, the lightning network, a second layer scaling proposal to see the realisation of fast and low cost transactions become a reality, saw successful implementation and ever-increasing adoption.

Top 10 cryptocurrencies in 2018

- The top four cryptocurrencies remained in their same positions by market cap at January 1, 2018, and December 31, 2018, with bitcoin (BTC) dominating the pack.

- Bitcoin (BTC) was followed by XRP in second place, Ethereum in third and Bitcoin Cash (BCH) in fourth place.

- From January 8 to November 14, Ethereum remained in second place ahead of XRP, changing positions briefly at the start and end of the year.

- Cardano (ADA) was in 5th place on January 1, 2018 but was pushed out of the top 10, to 11th place by December 31, 2018.

- Litecoin (LTC) was 6th place at the start of 2018 and moved down to 8th place by December 31, 2018.

- IOTA (MIOTA) was 7th place on January 1, 2018, and was also pushed out of the top 10 by the end of the year, moving to 12th spot.

- NEM (XEM) held 8th place by market cap on January 1, 2018 and dropped down eight places to 16th by the year’s end.

- In 9th place was Stellar (XLM) at the start of the year, and moved up to position six by December 31, 2018.

- Dash (DASH) was number 10 on January 1, 2018 but dropped to 15th place by December 31.

- By the end of 2018, four new cryptocurrencies were in the top 10 including EOS (EOS) (moving from position 13 on January 1 to position 5), Tether (USDT) (from 29th to 7), Bitcoin SV (BSV) (to 9th place) and TRON (TRX) (moving from 17th place to 10th).

Part 2

2019: The crypto spring

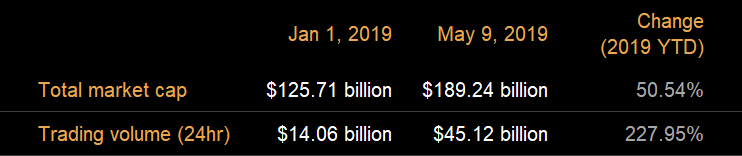

2019 Market capitalisation & trade volume

Note: Values are notional USD

2019 to date (January 1-May 9)

2019 kicked off with mixed sentiment and uncertainty. While maintaining its market share dominance, bitcoin trended sideways in the early months. The HiveEx trading desk saw a majority skew towards experienced clients taking an opportunity to re-enter the market, many adopting a strategy to average their purchase over a period of time to best protect a potential further decline.

On March 28 this year, we saw a 20% spike in the price of bitcoin during a single one-hour period. Post analysis indicates this came from a series of purchases of 1,000 bitcoin being executed across multiple exchanges, likely with the work of an institutional trading desk – either for themselves or a third party.

Since the 20% spike in late March, buyer sentiment has gradually increased, leading many to believe it signaled the end of the bear market.

It’s important to note that the space is not without it’s drama. Recently the exchange Bitfinex has come up against the New York Attorney General, putting its relationship with Tether under the spotlight. It was in relation to the borrowing of Tether reserves to cover an apparent US$850 million freezing of funds held in custody of one of the businesses banking partners.

Cryptocurrency market capitalisation in 2019

- Total market capitalisation has increased by 50.54% since the start of 2019, from $125.71 billion on January 1, 2019, to $189.24 billion on May 9, 2019.

- Despite the increase, it is still far from last year’s high of over $833 billion on January 8, 2018.

Cryptocurrency 24-hour trading volume 2019

- In the 24 hours of the first day of 2019, the cryptocurrency market reported $14.06 billion traded.

- By May 9, 2019, 24-hour trading volume increased more than three-fold (227.95%) to $46.12 billion.

- The past month has seen the highest activity of 24-hour trading volume ever recorded. On April 3, 2019, reported 24-hour trading volume hit over $88.40 billion.

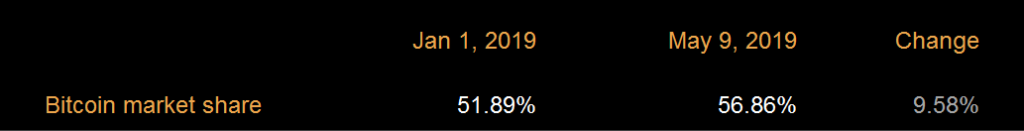

Bitcoin’s market dominance in 2019

2019 bitcoin market share

- Bitcoin remained strong throughout the first part of 2019 to May 9, growing its market share by 9.58%.

- On January 1, 2019, BTC recorded a 51.89% marker dominance, and increased to 56.86% by May 9, 2019.

- The market share of bitcoin is at the highest level since September 2018.

Bitcoin’s price growth in 2019

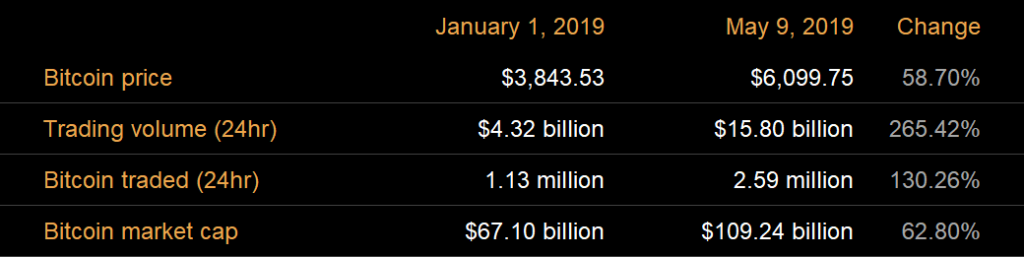

2019 bitcoin growth

- The price of bitcoin (BTC) has jumped by 58.70% this year, from $3,843.52 on January 1, 2019, to $6,099.75 on May 9, 2019.

- It’s the first time BTC has broken through the $6,000 barrier since November 2018.

- BTC 24-hour trading volume increased over three-fold (265.42%) this year, trading a total of $4.32 billion on January 1, 2019, compared to $15.80 billion on May 9, 2019.

- Based on the above figures, there were almost 1.47 million more BTC traded in the 24 hours of May 9, 2019 (2.59 million), compared to January 1, 2019 (1.13 million).

Part 3

2019 trajectory & looking beyond

While it’s important to understand the more recent events of the cryptocurrency space, it can prove to be extremely valuable to reflect on the longer term horizon.

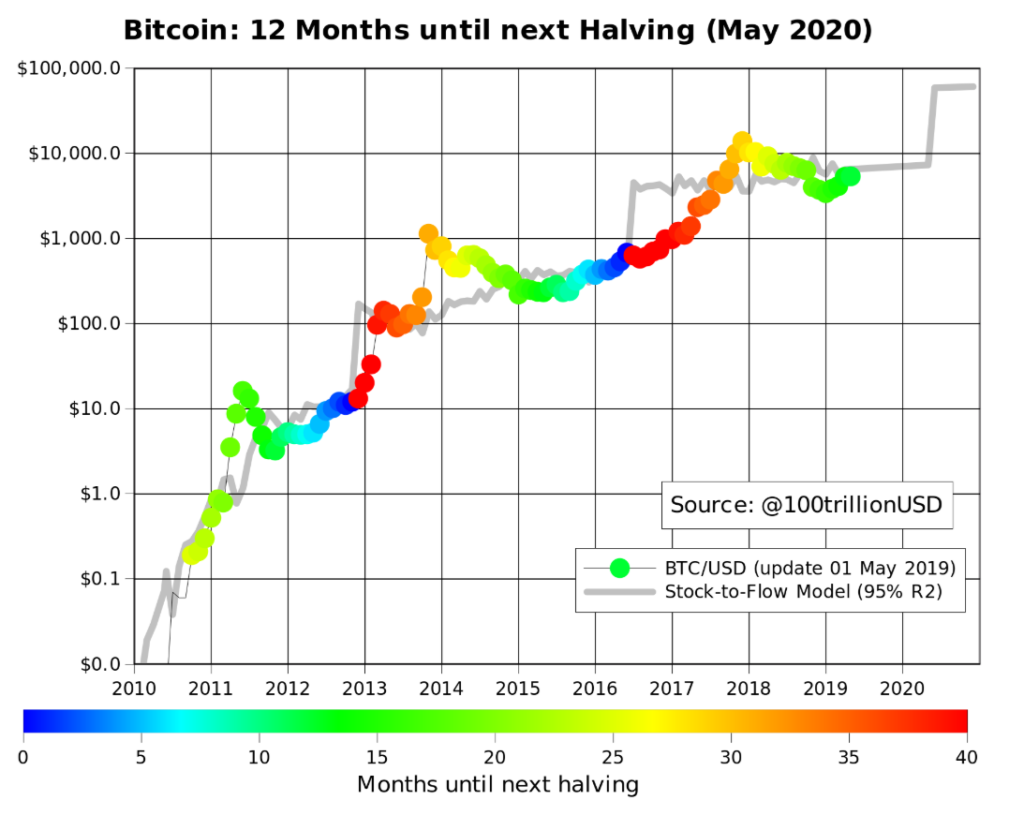

New bitcoin is created approximately every 10 minutes and given as a reward to the owners of computers that dedicate computing power to securing all transactions that occur on the bitcoin blockchain.

Every four years, the amount of bitcoin given in this reward, halves – this is known as the “halving”.

Each halving reduces the rate of supply of Bitcoin, and historically has been found to correlate to how the market values the cryptocurrency.

The below chart plots out the bitcoin price, colours the price by the number of months remaining until the rate of supply will next halve, and plots the stock-to-flow ratio during the time period.

Stock-to-flow is a ratio that compares the amount of bitcoin currently in circulation and available in market (the stock), and compares this to the rate of flow, or the number of new bitcoin entering the market over time.

Bitcoin Price / Months before supply halving / Stock-to-Flow ratio

While past performance is not an indicator of future performance, the methodology behind this model can be shown to consistently correlate to the value of bitcoin, even when backdated to exclude data from recent months.

Despite all the hype and drama associated with cryptocurrency throughout 2018, and indeed the years before it, it is a point of interest to see how things line up when reflecting on the bear market of 2018 and the recent price changes in 2019.

Methodology

The HiveEx Cryptocurrency Landscape Report 2019 compiled and analysed price, trading volume and market capitalisation from CoinMarketCap.

The number of BTC traded in each period was calculated by dividing the 24-hour trading volume by the price recorded at each period.

ICO data was sourced from icodata.io

Bitcoin halving chart was sourced from Twitter (@100trillionUSD)

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade. Cryptocurrencies and ICOs are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own independent legal, tax and accounting advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators’ websites before making any decision.